Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file schedule c form instructions?

Schedule C is a form used by self-employed individuals to report their business income and expenses to the Internal Revenue Service (IRS). This form is required to be filled out and filed with the IRS by anyone who is self-employed or who owns a business and reports more than $400 in net business income on their federal income tax return.

How to fill out schedule c form instructions?

1. Start by gathering your financial information, including your gross receipts, cost of goods sold, and other expenses associated with your business.

2. Gather your business tax forms, such as your 1099s, W-2s, 1098s, and other forms related to your business income.

3. Download a copy of the Schedule C form from the IRS website or obtain a copy from a tax professional.

4. Fill out the top portion of the form, including your name, Social Security number, and business name.

5. Enter your gross receipts in Part I, line 1.

6. Enter any returns, allowances, and discounts in Part I, line 2.

7. Subtract line 2 from line 1 to get your net sales. Enter this amount in Part I, line 3.

8. Enter your cost of goods sold in Part II, line 4.

9. Subtract line 4 from line 3 to get your gross profit. Enter this amount in Part II, line 5.

10. Enter your expenses in Part III, line 6.

11. Subtract line 6 from line 5 to get your total net profit or loss. Enter this amount in Part III, line 7.

12. Enter any taxes or fees in Part IV, line 8.

13. Add lines 7 and 8 to get your total net profit or loss. Enter this amount in Part IV, line 9.

14. Sign and date the form at the bottom.

15. Submit the form to the IRS.

What is the purpose of schedule c form instructions?

The Schedule C Form instructions provide information about how to complete the form for reporting business income and expenses on your federal income tax return. They provide detailed instructions on how to properly report business income and expenses, what types of records to keep, how to report losses, and more.

What information must be reported on schedule c form instructions?

Schedule C is used to report income or loss from a business you operated or a profession you practiced as a sole proprietor. The form includes several sections that require information about the business, such as the name, address, business activity, and the total amount of expenses and income. It also requires information about the type of business, such as the type of goods or services sold, the number of employees, and the method of accounting used. Other information that must be reported on Schedule C includes the total cost of goods sold, total gross receipts, total deductible expenses, and net profit or loss for the year.

What is schedule c form instructions?

Schedule C is a tax form used by self-employed individuals to report their income and expenses from a business or profession. The form provides instructions on how to calculate the net profit or loss from the business activity, which is then reported on the individual's personal income tax return (Form 1040).

The instructions for Schedule C provide guidance on various topics, including:

1. Business information: The instructions explain how to provide details about the business or profession, such as the name, address, and Employer Identification Number (if applicable).

2. Income: The instructions explain how to report various types of business income, such as sales, services, rental income, and other sources of revenue.

3. Expenses: The instructions provide guidance on deductible business expenses, including categories such as supplies, advertising, travel, office expenses, and insurance. The instructions also explain how to calculate the deductible portion of expenses related to the use of a home or vehicle for business purposes.

4. Cost of goods sold: If the business involves selling products, the instructions explain how to calculate the cost of goods sold, which is subtracted from the business income to determine the gross profit.

5. Net profit or loss: The instructions provide a step-by-step process for calculating the net profit or loss from the business activity, which is then reported on the individual's personal tax return.

6. Additional information: The instructions also cover topics such as depreciation and amortization of business assets, reporting income and expenses from a partnership or S corporation, and calculating self-employment tax.

It is important for individuals to carefully review the Schedule C instructions and consult with a tax professional if needed to ensure accurate reporting of income and expenses from their business or profession.

How can I manage my form 1065 schedule c instructions directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your schedule c 1065 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify 1065 paperwork rev without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 1065 filers, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out the form 1065 c form form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form1065 rev printable and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

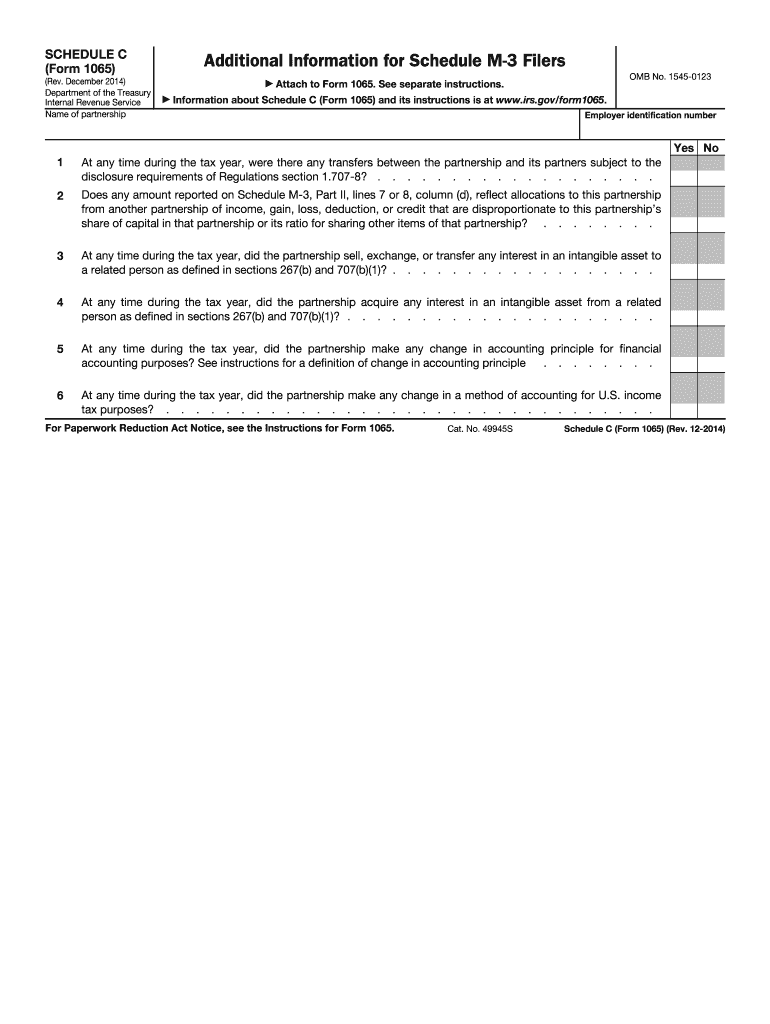

What is IRS 1065 - Schedule C?

IRS 1065 - Schedule C is a tax form used by partnerships to report income, deductions, and other financial details of the business. It is used to calculate the profit or loss of the partnership.

Who is required to file IRS 1065 - Schedule C?

Partnerships formed in the United States, including limited partnerships and limited liability companies (LLCs) treated as partnerships, are required to file IRS 1065 - Schedule C.

How to fill out IRS 1065 - Schedule C?

To fill out IRS 1065 - Schedule C, gather the financial details of the partnership's income and expenses for the year, complete the income section, list deductible business expenses, and ensure accuracy before submitting it along with IRS Form 1065.

What is the purpose of IRS 1065 - Schedule C?

The purpose of IRS 1065 - Schedule C is to report the financial performance of a partnership, to allocate income and deductions to partners, and to determine each partner's share of the partnership's profits or losses for tax purposes.

What information must be reported on IRS 1065 - Schedule C?

IRS 1065 - Schedule C must report information including the partnership's total income, business expenses (such as cost of goods sold, rent, wages, and utilities), and other financial details relevant to the partnership's operation.